Succession Planning

Family owned businesses are core to the Indian business environment. Many of these companies continue to be managed by family members themselves. While these businesses grow from one generation to another, it is observed that less than 10% of the businesses survive after the forth generation.

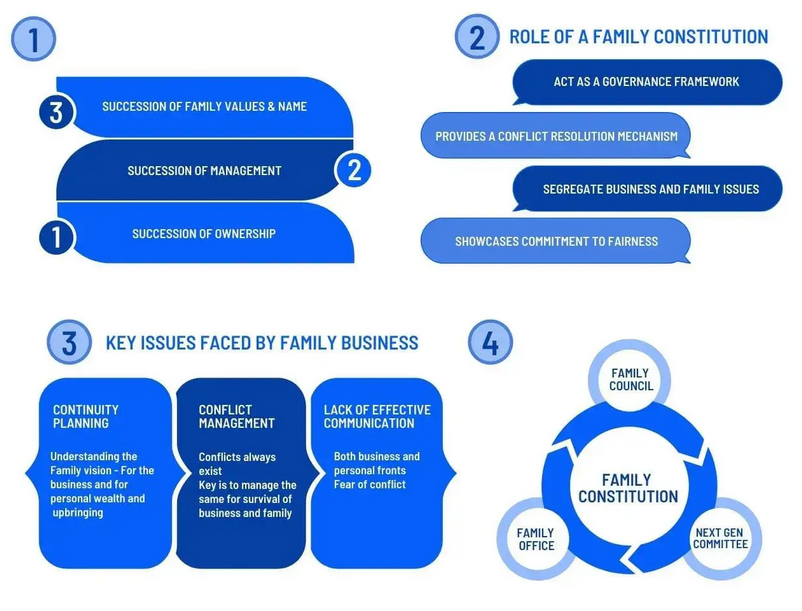

Planning succession encompasses succession of ownership, succession of management and succession of family values and name. Typically, continuity planning, conflict management and lack of effective communication are issues that are faced by all family run businesses. Given the culture inherent to Indian families, protecting the family ethos and relationships is paramount. Further, younger generations are seeking more structured support in leadership development, mentoring and role definition to realise their business goals.

At Transaction Square, we understand the importance of succession planning and work with many families to manage the generational change. We help in differentiating between the business issues (such as deciding the business strategy, choosing the future leaders for business, attracting professional management) and the family issues (leadership development, engaging the next generation, conflict management approach, reinvestment of profits, spent on education, marriage, social status) and assist the family members in decision making. We help families design and set up their Family Constitution that act as a governance framework for all business and family aspects. We assist in setting up a family council, next generation council, family office and identify suitable protocols for conflict resolution and future growth.

We even assist in identifying alternate ownership structures for the family (such as holding companies, LLP, Trust etc.) for wealth maximization and protection, in line with the business objectives. We critically evaluate the said options from a tax and regulatory perspective, assist in selecting the most appropriate solution and thereafter in implementing the same (including drafting of trust deeds, settlement agreements, wills, letter of wishes, family protocols etc.). With our deep knowledge in the field of tax and regulatory, we identify the impact of changing laws and business environment on succession and inheritance of wealth.

Our experts in this space even assist in situations of dispute in families, arbitration, asset distribution, family settlement etc. and provide suitable inputs from a tax, regulatory and business perspective. - by A M B JAIN & CO.