Family Office

The family office landscape has significantly evolved over the last few decades. Earlier the CFO of the flagship business was also responsible to manage promoter wealth and promoter entities. However, with the ever-changing tax and regulatory landscape, newer opportunities, and complex financial products being developed for High Net-worth Individuals, the need for a dedicated family office has emerged.

While the majority of professional firms rendering service to a Family Office have a background in Investment Banking or wealth management, at Transaction square we believe that promoters need a non-conflicted trusted advisor, who in a true sense can act as CFO for the family and partner with them always keeping the interest of promoter first.

Challenges Faced By HNIs :

- How do i preserve and enhanced my existing wealth?

- whom can i trust for an un-biased investment advice?

- How to assess and mitigate varius other risks?

- How do I ensure longevity of my family assets?

- How do I efficiently finance my philanthropy amidst all this?

- How do I keep track and manage my assets?

- How do I create assets outside of India? Who will help manage this?

- How do I bequeath my assets to my future generations? What vehicle to use?

- How do I optimize tax?

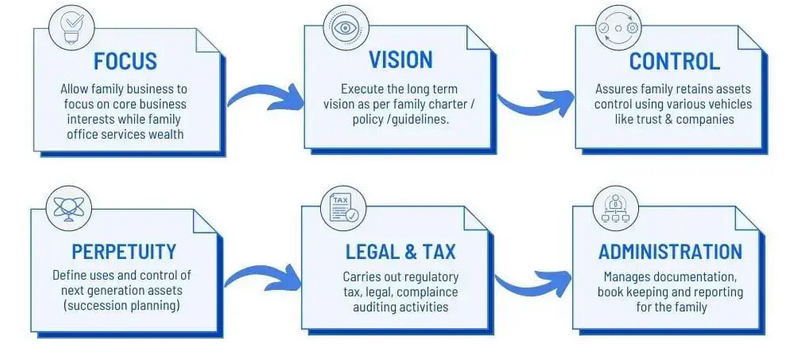

Benefits of Family Office

Our Service Offering

- Estate planning: Advising on wills and trusts for the transition of estate and implementing the same.

- A succession of business: Advising on the succession of ownership and management of family business

- Family governance: Family charter & constitution, Family settlements, helping in family togetherness & wellness

- Tax efficiency in Family Office: Evaluate the existing liquidity, source of funds, non-business assets and structure the promoter entities/ liquidity source to plug tax leakages and increase overall efficiency

- & Regulatory planning, compliances and reporting: Entire gamut of services tailored for family offices

- Global services: Immigration and residency planning, Estate and gift tax planning, Income-tax treaty and FEMA analysis, Foreign reporting and compliances

- Philanthropy: Set-up Charitable foundation, plan CSR, and achieve philanthropic objectives

- Insurance management: Advise and assist in obtaining necessary insurance (Tax, Term, etc) to shield against business/ professional risk

- Accounting/ Book-keeping: Help promoters maintain the accounts updated and compliant. Present dashboard on weekly basis for overview and actionable

For everything else, we shall act as a concierge to arrange the best-in-class real estate advisor/ Investment bankers/ wealth managers and ensure everything needed by Family is efficiently catered to by us acting as a one-stop solution. - by A M B JAIN & CO.